tl;dr

• FOMC, FDIC and OCC confirm banks can still deal in crypto but highlight liquidity concerns• Coinbase creates new layer 2 on Optimism's technology, aims to become fiat onramp for DApps in the future• Dapper Labs sheds 205 staffers (20%) to further tighten their belt following court ruling• IMF sugg...

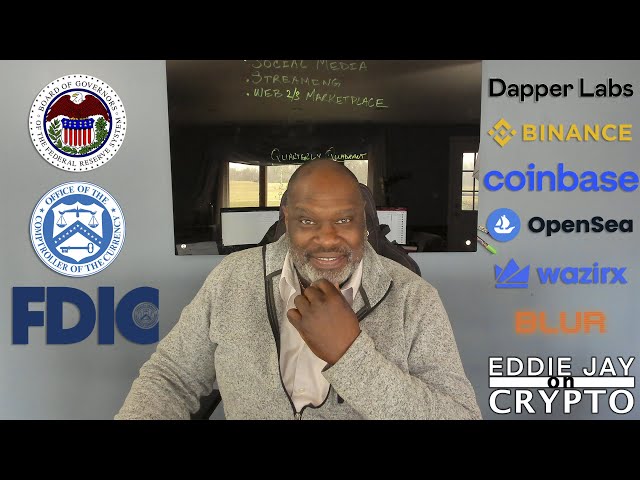

• FOMC, FDIC and OCC confirm banks can still deal in crypto but highlight liquidity concerns

• Coinbase creates new layer 2 on Optimism's technology, aims to become fiat onramp for DApps in the future

• Dapper Labs sheds 205 staffers (20%) to further tighten their belt following court ruling

• IMF suggests full crypto ban and advises against legal tender status, despite lacking power to stop digital assets

• Binance mislabels 500 users as wholesale investors in Australia, rectifies mistake, and regulatory body investigates

• WazirX shuts down NFT marketplace, users expected to move to OpenSea

Coinbase flashes what they think their future will be. Here is what is on my mind today.

1. The FOMC, FDIC and OCC stated banks are still allowed to deal in crypto. Their overall position is that crypto is risky, but there is nothing hampering banks as there are no new principles for banks dealing with crypto. The triumvirate went a step further by releasing a clarifying statement that servicing the crypto industry is neither illegal nor discouraged, although the FOMC has made liquidity a clear concern. That last part gets me.

2. Yesterday, Coinbase made a big announcement about them creating a new layer 2 on Optimism's technology. Optimism rose dramatically on the announcement, but Coinbase stock did not. This could be because of two things. The first being that the only thing released was the testnet and the mainnet is not expected to be released until 2024. The second is that people do not understand the play. Coinbase wants to be a fiat onramp for DApps in the future. Most assuredly, that will attract a lot of development on their Layer 2. Coinbase has figured out that the future of crypto is going to be predominantly non-custodial and this is where they can possibly generate even more revenue as they would become a part of the connective tissue as I call it.

3. It is not surprising that in the light of the court ruling Dapper Labs was hit with that they would have to tighten their belt. I knew they saw it coming and had already planned the layoffs, but the timing of the shedding of 205 of their staffers is almost uncanny.

4. The IMF says a full ban on crypto, although not ideal, should not be ruled out. They have also officially stated that crypto should not be given legal tender status. Talk about audacity. The IMF does not have the power to stop a stateless digital asset. The most they can do is advise and looks like they are being made the fool of. This is a master class in self-affliction. At some point, history will show the IMF had to be dragged kicking and screaming to the new world in which crypto is widely accepted and adopted.

5. Binance has yet another regulatory misstep. This time it is in Australia. The company stated they mislabeled 500 users as being wholesale investors. Thusly, they were allowed to take risky derivative positions. Once the company discover the faux pas, they immediately shut down the accounts and will make the users whole for their losses. As a result the Australian Securities and Investments Commission is taking a look under the hood. In my book, a mistake was made, rectified and the regulatory bodies were notified. Binance is learning speed can be key in these situations. Now they have to dig deeper and learn to not make the mistake in the first place.

6. WazirX is licking its wounds and shutting down their NFT marketplace. Launched in 2021, it was the first in India, but it never really caught on. This is a smart move for the exchanged, but I think history will be kind and show it was simply ahead of its time in that region. Users are expected to move to OpenSea. It would have been a big win had Blur gotten that business. OpenSea needs the boost since Blur has surpassed them.