tl;dr

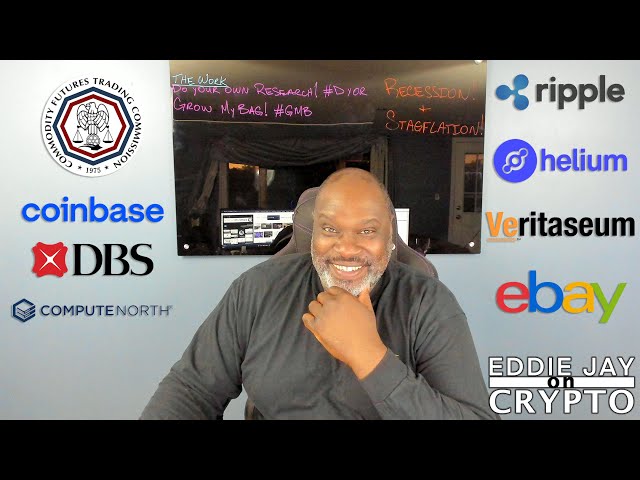

• CFTC steals from the SEC playbook going after DAOs and founders• XRP has only exploded because of the lawsuit progress; where is the utility• Coinbase gets sued again, this time over alleged patent infringement• Helium is a mess and Forbes uncovered a lot of insider shenanigans• Singapore's DBS Ba...

• CFTC steals from the SEC playbook going after DAOs and founders

• XRP has only exploded because of the lawsuit progress; where is the utility

• Coinbase gets sued again, this time over alleged patent infringement

• Helium is a mess and Forbes uncovered a lot of insider shenanigans

• Singapore's DBS Bank offering crypto services to institutions and wealthy, but not the masses

• Compute North, a major crypto hosting provider, files for bankruptcy

There are a lot of events that are going on right now that will have reverberating effects on the Cryptoverse. Here is what is on my mind for today's Sunday Roundup.

1. While everyone has been paying attention to the SEC the CFTC has not so quietly taken a play from the SEC's playbook. The CFTC Sued a DAO and its founders. As you might have guessed, this is sending a very clear message to DAOs and founders alike. This has me thinking about what could be about to unfold between the SEC and the CFTC. Whatever is coming it is not going to be pretty. DAO members are beginning to question whether or not they should stick with their roles.

2. XRP has taken off and even touched over its resistance level of $0.50. If you have been holding it before this run up, you are probably pretty happy. I am , too. That said, I do wonder about its ability to sustain the momentum. I don't have to be sold on the underlying technology, XRP Ledger, but I do wonder about the coin itself. I apply that thinking to all of the coins I research, along with other criteria.

3. Coinbase is facing a$350M lawsuit from Veritaseum Capital over alleged patent infringement. Veritaseum Capital has identified some of Coinbase's core technologies as having infringed on the patent's technology. The technology facilitates low-trust peer-to-peer value transfer and is dependent upon a third party. Coinbase Wallet, Coinbase Pay Coinbase Commerce API and other core Coinbase technology are called into question. If you have done your research on the dotcom boom and bust, This should be reminiscent of the case brought against eBay by MercExchange. Eventually, eBay bought all 3 patents involved in the lawsuit. It is going to be interesting to watch this play out.

4. Helium is a mess. A Forbes article has released blockbuster news that 30 wallets connected to Helium insiders, such as employees, their families, friends and early executives. The report says they had mined about 25% of the HNT tokens by the sixth month of launch. As this story continues to break I think things are going to get far worse. I also wonder if this is going to have an effect on the T-Mobile deal. I am wondering if this is a very elaborate rug pull.

5. DBS Bank, Singapore's largest bank , is about to offer crypto services to its "accredited investors". Accredited investors will be able to trade Bitcoin, Bitcoin Cash, Ethereum and XRP on what they are calling their institutional-grade custodial infrastructure dubbed DDEx. It is not lost on me that DBS was licensed by the Monetary Authority of Singapore (MAS) given their size and political influence. While MAS supports blockchain technology it frowns upon retail investors having access to crypto. So companies in the space are restricted from public advertisements. Remember what I said about how Jamie Dimon thinks cryptos are Ponzi schemes while JPMorgan offers services to institutions and the affluent. This is another clear example epitomizing haves versus have-nots.

6. Unable to pay the $500M that has come due, Compute North, a major crypto hosting services provider, filed for bankruptcy. With clients like Marathon Digital, Hive blockchain, Bit Digital and more, they're going to restructure and wait crypto winter eases. Marathon released a statement saying their operations will not be affected.