tl;dr

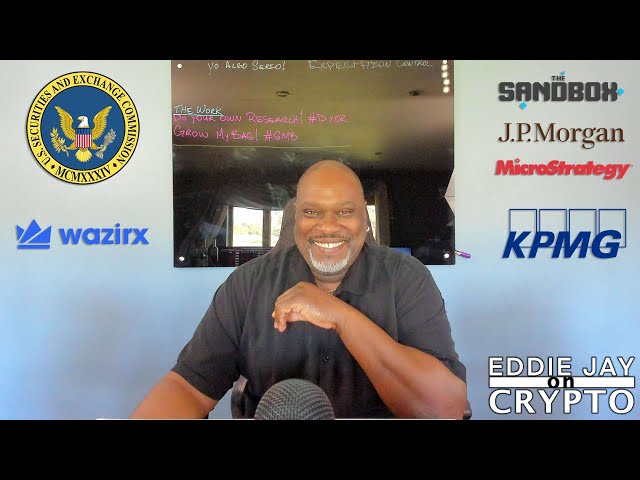

• CPI numbers come out tomorrow and will tell us how the fight against inflation is going• DBS, Singapore's largest bank, is making big noise in The Sandbox• The SEC is creating a new unit for Crypto issuer filing• Did you know JPMorgan is still on a Web3 hiring spree• MicroStrategy is about to sell...

• CPI numbers come out tomorrow and will tell us how the fight against inflation is going

• DBS, Singapore's largest bank, is making big noise in The Sandbox

• The SEC is creating a new unit for Crypto issuer filing

• Did you know JPMorgan is still on a Web3 hiring spree

• MicroStrategy is about to sell $500M worth of stock for another Bitcoin buy

• India unfreezes bank account of WazirX citing cooperation by the exchange

We all know this is going to be a huge week. Here is what is on my mind today.

1. CPI numbers are out tomorrow and that is going to tell us how we are doing against inflation. I am expecting the numbers to come in fairly OK. More importantly, if that is the case, I would factor in a 50 basis point raise instead of a 75. If the numbers are bad, then I would expect the 75 and depending on how bad, we could see 100. All of that said, I think we are in the 75 range. Why? Because I do not think the numbers will be good enough and that would call for the more hawkish 75. The reasoning would be so they can ensure the numbers are getting better and would stay on that trend when they begin to pull back.

2. DBS, Singapore's largest bank, is making big noise in The Sandbox. Remember, The Sandbox ($SAND) is an Ethereum-based metaverse and is the second largest by market cap. That said, they have been enjoying some nice news in the past few weeks and the current number one, Decentraland, has had barely any. The Sandbox has had so much upward momentum it is not all that far away from bunny-hopping Decentraland in market cap. It could happen as soon as today as this news spreads.

3. The SEC is creating a new unit for Crypto issuer filing. This move would be a good thing if it wasn't all about enforcement. Gary Gensler continues to rule by enforcement in lieu of working to create transparent regulation. The SEC cites the growth of the industry as the reason why the unit is necessary. Growth in the industry has even been cited by KPMG who released a report saying even with the war and inflation, the Cryptoverse continues to thrive.

4. Did you know JPMorgan is still on a Web3 hiring spree? This should not be a surprise to anyone. JPMorgan's blockchain collateral settlement platform, Onyx Digital Assets, started operating setting collateral in May using their native digital asset, JP Coin. They are also looking to tokenize a trillion dollars. They are already receiving money market from BlackRock. This new phase of hires are going to be focused on payments. I keep saying, watch how traditional finance moves. The winners will be the institution that best combines the power of traditional finance and the Cryptoverse. This is why FTX is quickly moving in the opposite direction. Both firms having the same idea to bring both to the table for clients.

5. You know Things are heating up when MicroStrategy says they are going to sell some shares for another Bitcoin buy and that is exactly what has happened. Michael Saylor's MicroStrategy made the announcement over the weekend and things are starting to look up. They are almost always OTC transactions, but I think it will still have a favorable effect on the crypto market.

6. In a surprising move, India has unfrozen the bank account of crypto exchange WazirX. I have been waiting to see how this fiasco was coming along. Apparently, WazirX has been cooperating with authorities, providing them with information on some of the 16 fintech companies currently being investigated by the Enforcement Directorate. This still leaves another question open for me. Is WazirX a holding of Binance or not?