tl;dr

India's UPI expands to Qatar, marking a major leap in cross-border digital payments. This partnership between NPCI, QNB, and NETSTARS aims to revolutionize transactions for travelers and businesses, showcasing India's fintech leadership.

**India’s UPI Expansion to Qatar Marks a New Era in Cross-Border Digital Payments**

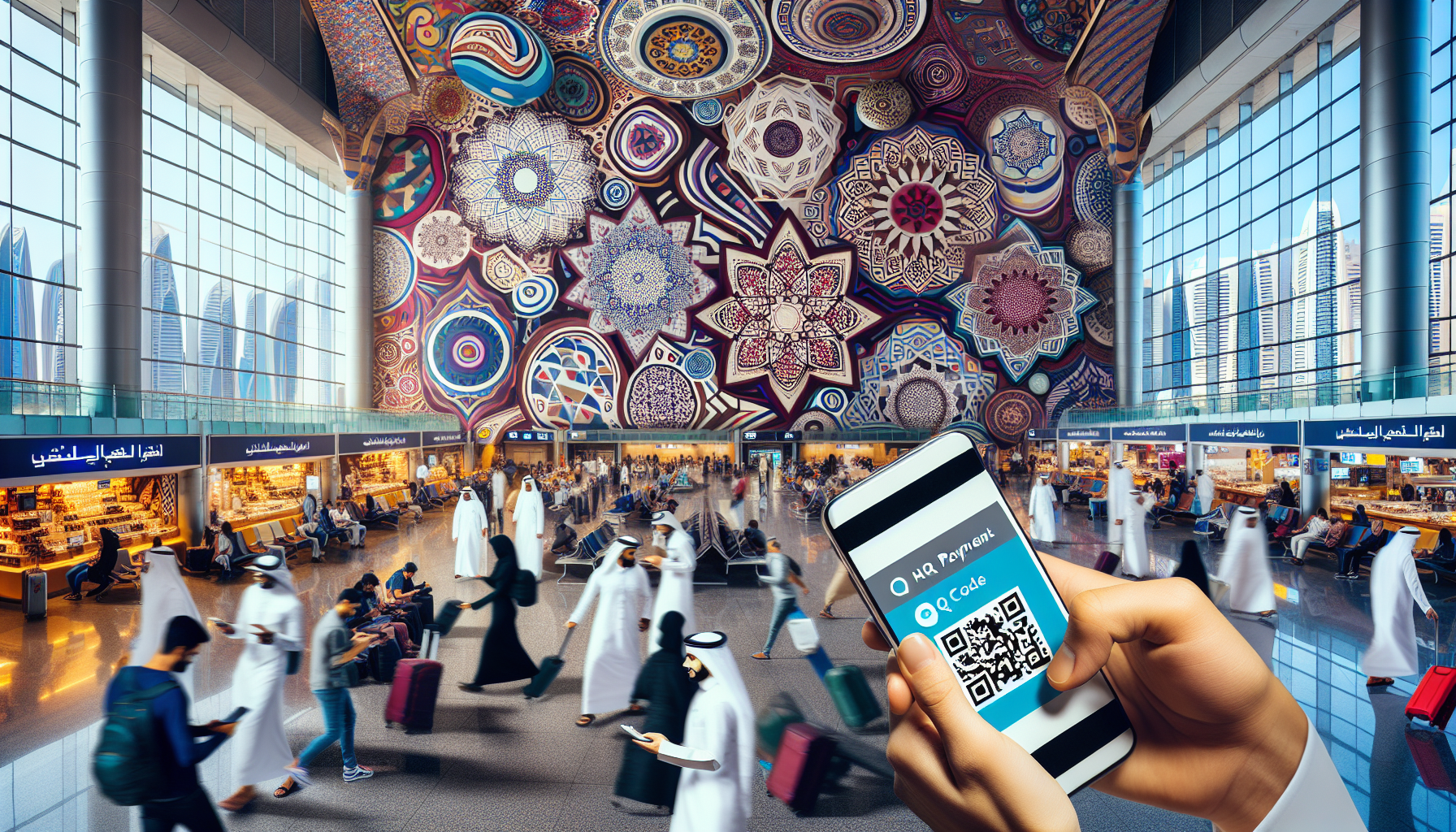

India’s Unified Payments Interface (UPI), a cornerstone of the country’s digital payment revolution, has made its global debut in Qatar. This landmark move, announced as part of a strategic collaboration between NPCI International Payments Ltd (NIPL), Qatar National Bank (QNB), and Japanese payments gateway NETSTARS, marks Qatar as the eighth country to adopt UPI. The initiative, initially rolled out at Hamad International Airport’s duty-free stores, aims to streamline real-time, cashless transactions for Indian tourists and Qatari businesses, while reinforcing India’s growing influence in the global fintech arena.

### A Strategic Partnership for Digital Transformation

The expansion of UPI to Qatar is a result of a tripartite partnership between NIPL, QNB, and NETSTARS. NIPL, the international arm of India’s National Payments Corporation of India (NPCI), has partnered with QNB to enable QR code-based UPI payments through point-of-sale (POS) terminals for merchants under QNB’s network, powered by NETSTARS’ payment solutions. This collaboration seeks to enhance digital payment accessibility for Indian travelers, who are the second-largest group of international visitors to Qatar, and to bolster Qatari businesses by reducing reliance on foreign currency or international cards.

Ritesh Shukla, Managing Director and CEO of NIPL, emphasized the significance of the partnership: “This milestone is a step toward creating a truly interoperable global payment network. It will help millions of Indian travelers make seamless, secure digital transactions while reducing their dependence on cash.”

### Boosting Tourism and Retail Through UPI

The introduction of UPI in Qatar is expected to catalyze growth in the retail and tourism sectors. By enabling instant, secure transactions, the initiative aims to attract more Indian tourists and provide them with a frictionless payment experience. For Qatari merchants, particularly those affiliated with QNB, this could translate to increased transaction volumes and customer engagement.

Yousef Mahmoud Al-Neama, Group Chief Business Officer at QNB, highlighted the mutual benefits: “This milestone enhances convenience for Indian travelers and brings significant advantages to the Qatari market by promoting cashless transactions, boosting retail and tourist sectors, and strengthening interoperability in the payments ecosystem.” QNB, a leading financial institution in the Middle East and Africa, has a presence in over 28 countries, positioning it as a key player in this cross-border digital payment initiative.

### NETSTARS: Bridging Global Payment Ecosystems

Japanese payments gateway NETSTARS, which has over 450,000 access points in Japan, played a pivotal role in facilitating UPI’s entry into Qatar. The company, known for introducing China’s WeChat Pay to Japan in 2015, has developed StarPay—a platform that integrates various QR code-based payment systems. Tsuyoshi Ri, CEO of NETSTARS, expressed pride in the partnership: “This aligns with our mission to expand seamless and secure payment experiences globally. We are proud to empower local merchants in Qatar to accept digital payments from millions of international travelers.”

### Strengthening India-Qatar Ties Beyond Energy

The UPI expansion underscores the deepening economic and strategic ties between India and Qatar. While energy has historically been a cornerstone of their trade relationship, both nations are now pivoting toward innovation-driven sectors such as artificial intelligence, semiconductors, quantum computing, and the Internet of Things (IoT). In February 2024, Qatar pledged a $10 billion investment in India, signaling a shift toward diversified collaboration.

India’s Commerce Minister, Piyush Goyal, highlighted this transformation at the India-Qatar Business Forum: “We are transitioning from energy being the bulwark of our trade to AI, IoT, quantum computing, and semiconductors.” Bilateral trade reached $15 billion in FY 2023-24, with Qatar ranking among India’s top three Gulf Cooperation Council (GCC) investors.

### A Win-Win for Global Fintech

The UPI rollout in Qatar not only enhances convenience for travelers but also underscores India’s leadership in shaping a global digital payments ecosystem. By fostering interoperability and reducing barriers to cross-border transactions, this initiative sets a precedent for other nations to adopt UPI, further solidifying India’s role as a fintech innovator.

As India and Qatar continue to strengthen their partnership across sectors, the integration of UPI in Qatar exemplifies how technology can bridge geographical and economic divides, creating a more connected and inclusive global market. For now, travelers to Qatar can look forward to a smoother, cashless experience—and businesses to a new era of digital growth.